What to do if your adjustable-rate mortgage (ARM) is about to adjust

Key Takeaways

- Every ARM will eventually adjust by a set percentage, provided in your original loan documents and in the rate change notice from your lender

- Your main options are to accept the change and re-evaluate at a later date, or shop for a new home loan

- The best option for you depends on your needs, goals, and budget

You’ve just received a letter from your mortgage company that says the interest rate on your adjustable-rate mortgage (ARM) is going up, and your new payment is going to be hundreds of dollars more per month.

You feel an invisible weight settle on your chest. What will you do?

Take a deep breath. Yes, a mortgage payment that suddenly increases can be scary. But once you understand how ARMs work and what your options are, you’ll be able to figure out the best choice to protect your finances and your home. If this is your first rate adjustment, you should have at least six months to figure out what will work best for your family.

Many borrowers who got an ARM in the past decade made that choice because a few years ago, mortgage interest rates hit a 30-year historical low. Borrowers with good credit could qualify for a mortgage with an interest rate under 5%. When you receive notice of your new rate and new estimated monthly payment, that can be alarming, because rates have risen since then.

An ARM is a type of home loan with a variable interest rate. When you choose an ARM, your initial interest rate is fixed for a period of time after closing. Typical initial rate periods are 3, 5, 7, and 10 years. Afterward, your interest rate adjusts periodically, usually at yearly intervals.

How do ARM adjustments work?

As an example, if you bought a home by taking out a 30-year ARM with a five-year initial adjustment cap and an annually adjusting feature, then you would have what is known as a “5/1 ARM.” For the first five years of your loan, your interest rate remains the same. After five years, your interest rate will adjust annually for the next 25 years.

While market fluctuations influence current mortgage rates, there are federal lending rules that set a cap on how much the rate can adjust. There are three kinds of rate caps:

- Initial adjustment cap: This cap limits how many percentage points the rate can increase or decrease the first time it adjusts. Common caps are 2% or 5%. If your initial rate is 3% with a 2% initial adjustment cap, your first adjustment rate cannot exceed 5%, even if mortgage rates rise by 4% (3% initial + 2% cap = 5% new rate).

- Subsequent adjustment cap: This cap limits how many points the rate can increase in the adjustment periods that follow. For annually-adjusting ARMs, that’s the limit on how much rates can rise from year to year. For most ARMs, this cap is 2%.

- Lifetime adjustment cap: This cap puts a ceiling on how high your ARM’s interest rate can ever rise. Most often, this rate is 5% over the initial rate, though it can be higher.

The takeaway here is that your ARM has an upper limit of how much it can rise, and it’s rare to see a rate rise by more than 5% at a time.

Know your loan terms

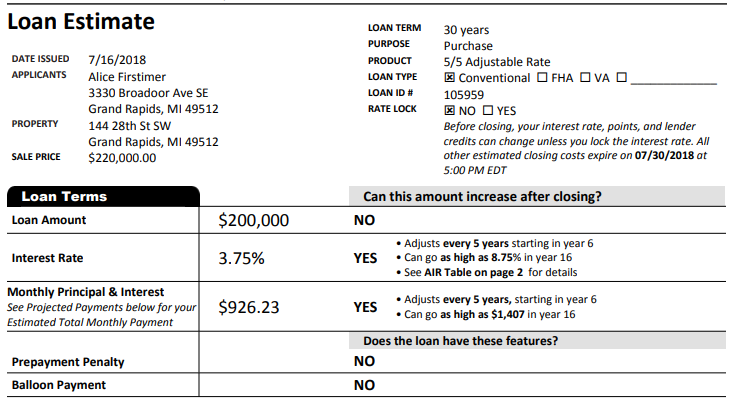

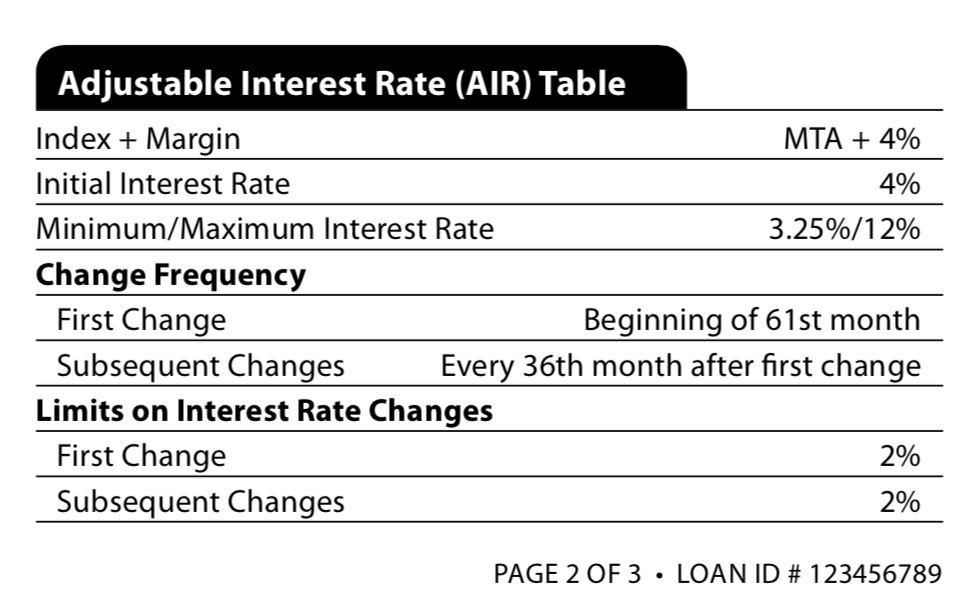

Feeling secure and prepared for the future – especially when it comes to your home – is worth a bit of preparation. An easy step you can take today is to look for your Loan Estimate or your Closing Disclosure. These documents spell out the key dates and percentages for your ARM.

Credit: Consumer Financial Protection Bureau, Loan estimate: Completed sample forms for Interest only, adjustable rate loan.

On both the Loan Estimate and Closing Disclosure, look for the Adjustable Interest Rate (AIR) Table for adjustment key dates and rate caps.

What are my options?

While there are ultimately two options – budget for the new monthly payment or shop for a new home loan – there are several considerations and strategies whichever direction fits you best.

Option 1: Let your rate adjust and check back next year

If you have an annually adjusting ARM and you can budget for the new monthly payment, you can accept the rate change and see what happens to rates next year.

This may be a good option for you if your credit isn’t optimal or if your new payment is easily affordable and you want to see whether rates drop next year.

Don’t mistake this as the “do nothing” option, though. If you decide not to make any changes to your home loan, you’ll probably want to adjust for the higher mortgage payment by cutting back elsewhere. That may mean opting for a staycation instead of an all-inclusive resort, or not eating out as often. It may also mean deciding not to take on new debt, like buying a car.

Not sure you can afford the new payment? Your mortgage lender will provide you contact information for housing counselors who can help you think through your options. Your credit union may also be able to help you find a better, more affordable mortgage option.

Option 2: Shop for a new home loan

Just because your ARM helped you buy your home doesn’t mean you’re stuck with that loan. If your credit is solid and you don’t want to rely on rates dropping, consider shopping around for a new mortgage.

You can refinance either to another ARM or to a fixed-rate loan. Why would you consider another ARM? ARM loans traditionally offer lower initial rates compared to a 30-year fixed rate mortgage. If you plan to move or refinance again in the next 5-10 years, you may be able to obtain a lower monthly payment on an ARM as opposed to a fixed rate loan.

Of course, fixed-rate loans offer predictability during the term of the loan, but they can be slightly more expensive over time. Fixed-rate loans come in various terms (10, 15, 20, 30 years, etc.). The rule of thumb is longer terms mean lower monthly payments, which can help you fit a fixed-rate mortgage into your budget.

No one knows what the future holds, but the last thing we want is to be caught off guard when it comes to the place we feel most comfortable and secure. Your best option depends on your financial needs and your short- and long-term goals.

If your ARM is about to adjust or you have an ARM and you want to talk options, contact us. We can help you prepare.