Choosing an adjustable-rate mortgage

If you think there’s a chance you’ll sell your home within 5-10 years, or you expect your income to increase and prefer a lower monthly payment for the first few years of your mortgage, an adjustable-rate mortgage (ARM) could be an attractive option.

It’s exciting to buy a house and think about the special memories you’ll build in your new home with family and friends. At the same time, you may also be thinking about potential changes in the future, like a job relocation.

An ARM can help homeowners save money by offering lower monthly payments initially. It might be the right choice if you think you’ll sell your home after a few years.

How it works

With an ARM, the interest rate on your mortgage can go up or down over time, which means your payment will also go up or down. However, your initial rate stays the same for the first 3, 5, 7 or 10 years depending on the specific ARM program you choose. After that your rate can adjust every year, or in some cases every 3 or 5 years. In return for accepting the risk of a higher rate in the future, the initial interest rate on ARM’s may be lower than a comparable fixed-rate mortgage. If you expect to sell your home within the first 5-10 years, it’s possible that you’d save money with an ARM versus a fixed rate mortgage.

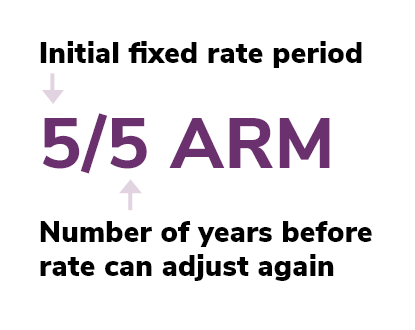

You’ll typically see an ARM referenced with two numbers separated by a slash (see graphic below). The first number references the initial number of years when the rate won’t change. The second number indicates how often it’s allowed to change once the initial period has expired. What your rate changes to depends on the “index” the lender uses for the specific ARM program you choose. Your loan documents will inform you what index the lender will use as well as how much “margin” they will add to the index to determine your new rate. However, there is a limit to how much your rate can change at each adjustment as well as over the life of the loan. These limits are called “caps” and will be disclosed to you when you apply for an adjustable rate mortgage.

To help illustrate, let’s look at an example. Say you took out a 5/1 ARM at a rate of 3% about five years ago and your rate is getting ready to adjust. The lender disclosed to you that your index would be the weekly average rate of the 1 year United States treasury bill and the “margin” for the loan would be 3 percent. Let’s say the 1 year t-bill is at 0.5% when your rate is ready to adjust. Your new rate will then be 0.5% plus 3%, or 3.5%, and your new monthly payment would be computed using the remaining balance of your loan with this new rate and the remaining repayment period.

Things to think about

You’ll want to consider several factors as you decide if an ARM fits your personal circumstances:

- How long will you stay in your home? Your job may require you to move in a few years, or you may decide you’d like to sell your house and move to another part of town at some point. In the first years of an ARM, you’re generally paying a lower interest rate than you would with a traditional fixed rate loan. So, if you do sell, you’ll have spent less money and potentially have more funds for your next home.

- Is there a chance you’ll pay off your loan early? Perhaps you’re in line to receive a large gift or inheritance, or you may plan to pay off your loan early due to an upcoming retirement. In these cases, an ARM could save you thousands of dollars in interest, especially if you pay off the loan before the initial rate changes. Some ARMs charge an additional fee if you pay off early, so shop around and choose an ARM without this feature if possible. You can rest assured that none of the ARMs we offer include pre-payment penalties.

- Are you comfortable with a fluctuating monthly payment? After the ARM’s initial fixed rate period, your monthly payment may rise or fall periodically. While ARMs usually limit the amount your payment can increase at each adjustment and over the life of the loan, it’s important to think about your budget and other commitments. If your payment increases, will you have the financial flexibility to make the new payment and still meet your other obligations? If rates fall and your payment is lower, you’ll save money.

Ready to get started? Contact your mortgage loan officer to learn more about getting a mortgage.